Published at

Key Facts

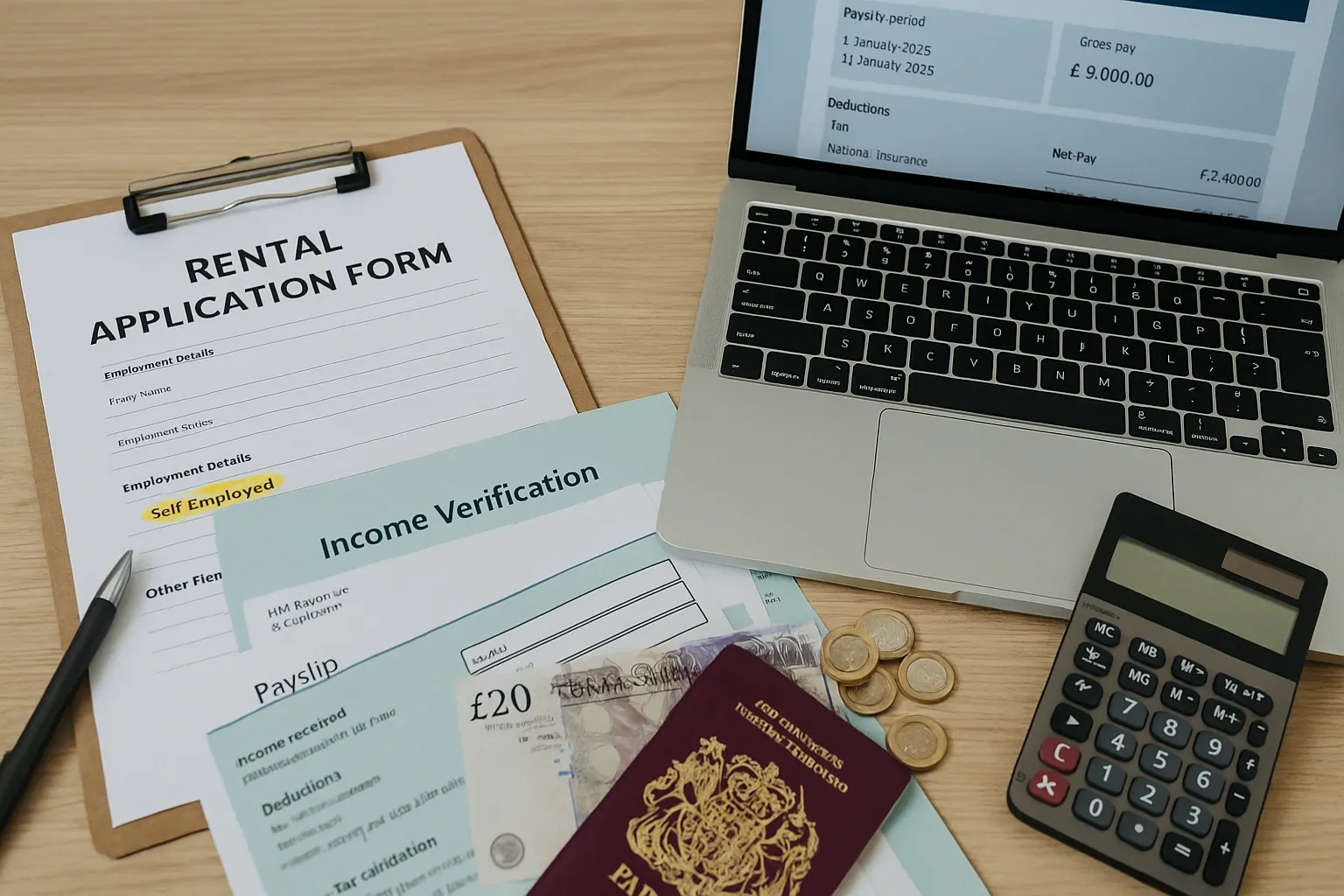

- Over 4.4 million UK residents are now self-employed

- Landlords often require 2+ years of accounts or tax returns

- Many agents ask for a guarantor or 6–12 months' rent upfront if income proof is limited

- Freelancers can boost their applications by showing steady client work and savings

- A polished rental CV and financial transparency help win trust

🧠 Introduction

If you're self-employed in the UK, you already know how rewarding (and unpredictable) freelance life can be. But when it comes to renting a home, irregular income and lack of payslips can make things complicated.

Agents and landlords want security. Without traditional employment, they need extra reassurance that you can pay rent reliably. Luckily, there are proven ways to make your application stronger, even without a fixed salary.

Let’s break down what self-employed renters need to prepare, what landlords expect, and how to increase your chances of getting approved.

1. What Do Landlords Look for?

Whether you're a full-time freelancer, limited company director, or contractor, landlords primarily want to see that:

- You can afford the rent

- Your income is consistent or reasonably predictable

- You're trustworthy and financially responsible

Most agents will want proof of your ability to pay rent for the duration of the tenancy.

Tip: Be proactive. The more proof you offer upfront, the easier it is to win landlord confidence.

2. Documents You’ll Likely Need

Here’s what to gather before applying:

- SA302 forms (self-assessment tax calculation summaries from HMRC for the last 2 years)

- Bank statements (ideally showing 6–12 months of income)

- Proof of savings or an emergency fund

- Letters from clients or current contracts

- Accountant reference letter confirming your income

- Photo ID and proof of address (e.g. utility bills)

If you have less than two years of trading history, you may also be asked for:

- A guarantor (someone who agrees to pay if you don’t)

- 6–12 months' rent in advance

✅ Related Article:

3. How to Strengthen Your Rental Application

If you’re self-employed, think like a business owner and present yourself professionally.

- Create a rental CV with your background, profession, and current housing history

- Highlight client testimonials or ongoing contracts

- Show a track record of on-time rent payments if possible

- Be upfront about your income situation and offer solutions like advance rent or a guarantor

- Provide proof of ongoing cash flow or retained earnings

4. Guarantors and Advance Rent Options

If your financials are borderline, agents might ask for one of the following:

- A UK-based guarantor earning 2.5–3 times the rent

- Six or twelve months' rent upfront, especially for short-term or uncertain income profiles

- A co-tenant with traditional employment to balance your application

Important: Guarantors will be credit checked and may be required to sign a deed of guarantee. Make sure they understand the legal responsibilities involved.

5. Renting While Running a Limited Company

If you operate as a limited company director, agents will usually request:

- Your latest company accounts

- Salary and dividend breakdowns

- An accountant’s confirmation letter

- Sometimes, personal bank statements in addition to business accounts

Note: Even if your business is profitable, many landlords want to assess your personal take-home income.

6. Useful Resources and Guidance

Self-Employed and House-Hunting?

Matchouse helps freelancers and business owners find flexible rental options and connect with agents who understand how non-traditional income works.

Browse Flexible Rentals