Published at

Key Facts

Key Facts

- Mortgage rates have dropped, making home loans cheaper.

- Relaxed affordability rules now allow buyers to borrow more.

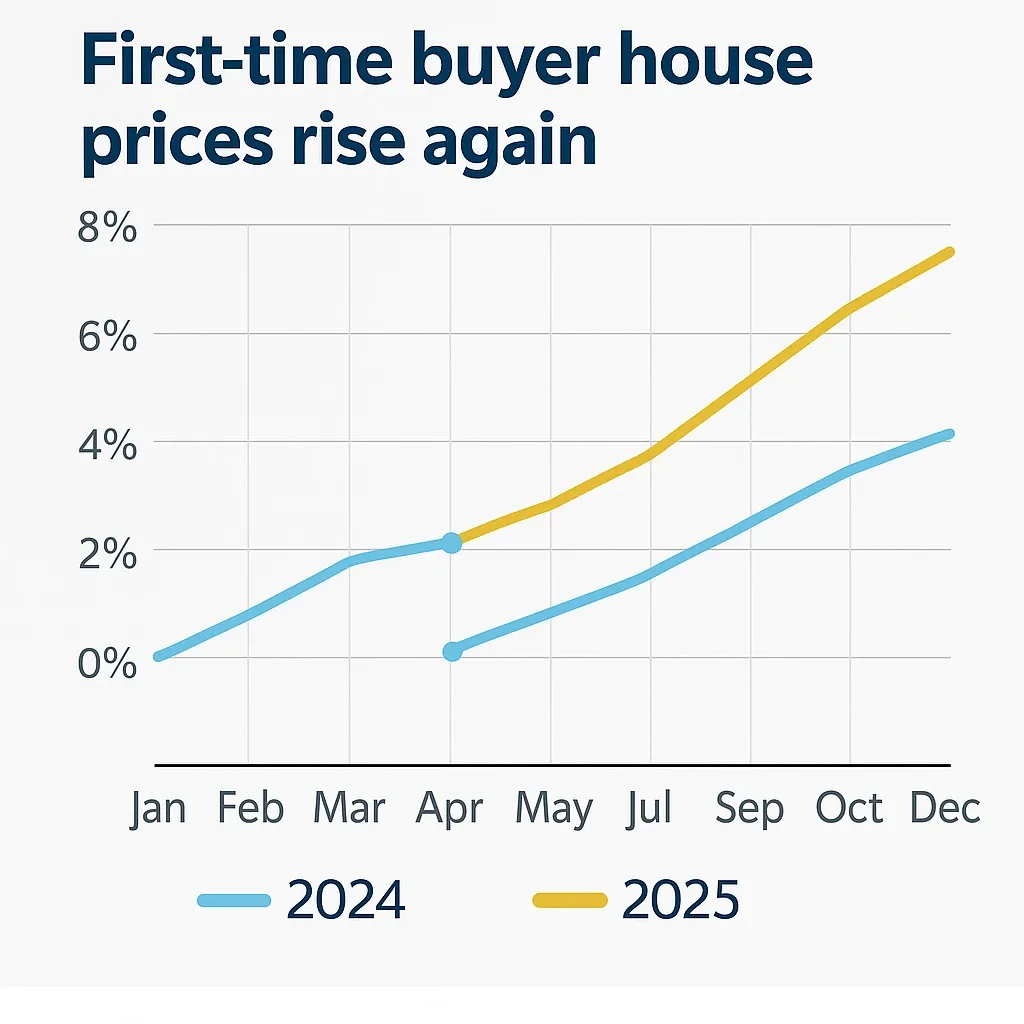

- The average price of first-time buyer homes jumped at the start of 2025.

- Stamp duty relief is still available until April 2025.

What’s Happening in 2025?

Why First-Time Buyers Are Paying More

Lenders like MPowered Mortgages analysed Land Registry data and found that average prices for first homes surged in early 2025. Two main reasons are driving this:

- Falling mortgage rates have made home loans more affordable.

- Relaxed lending rules mean buyers can now borrow more than before.

While this seems like a win, it also fuels higher demand, which pushes prices up especially in competitive areas.

Note: Lower interest rates can sometimes drive prices up faster than they save you money. Always run the numbers.

Should You Buy Now or Wait?

Pros and Cons for First-Time Buyers

Some benefits of buying now:

- You can still access reduced stamp duty until April 2025.

- Rates are low, which means lower monthly repayments.

- You may be able to borrow more, increasing your options.

But:

- You’re entering a market where prices are already rising again.

- If you over-borrow, future interest rate increases could hit hard.

Mortgage Access vs Market Conditions

| Lending Factor | Impact |

|---|---|

| Cheaper mortgages | Encourages more buyers |

| Looser lending rules | Buyers can borrow higher amounts |

| Stamp duty cuts | Increases demand, especially under £425,000 |

| Limited housing supply | Drives up prices again |

What First-Time Buyers Can Do

Smart Steps to Beat the Competition

- Get a mortgage in principle early to move fast.

- Work with a local property expert who understands price trends.

- Consider areas just outside hotspots for better value.

- Speak to mortgage brokers to compare deals beyond your main bank.

Ready to Buy, But Need Help?

Get matched with verified mortgage advisors, brokers and local experts who can guide your first purchase.

Find Help NowFinal Thoughts

Don’t Let Lower Rates Fool You

Cheaper mortgages sound like a golden opportunity, but they’re also adding fuel to price rises especially for first-time homes. The best move? Prepare early, know your budget, and surround yourself with the right advisors. This way, you’re not just buying a home, you’re making a smart long-term decision.

Related Article

Suggested External Sources

- This is Money: Mortgage changes push house prices higher (2025)

- GOV.UK – Stamp Duty Relief Explained

- MoneySavingExpert – First-Time Buyer Mortgage Advice